HR Duo is expanding its HR and payroll offering with Payroll Savings, sitting alongside On-Demand Pay (also known as Earned Wage Access), for UK users.

Rising living costs, limited savings, and short-term cash flow challenges are now everyday concerns for UK workers. Many employees are one unexpected expense away from financial stress, and when money worries build up, they arrive at work distracted and disengaged.

Payroll Savings gives employers a practical way to support both immediate pay flexibility and long-term financial wellbeing, all within one connected HR and payroll experience.

Your Workforce Wants the Support To Save

Most UK workers understand the importance of saving, but many struggle to get started. Saving feels like something they'll do later, rather than something payroll actively supports today. The reality across the UK workforce is stark:

- Nearly one in four UK adults (23%), around 12.5 million people, have no savings to fall back on in a crisis, according to new research from StepChange

- Around 80% are not saving enough to build even basic financial resilience

- Money worries are one of the leading causes of stress at work, impacting concentration, morale, and overall performance

Without a savings buffer, everyday issues such as car repairs, rent increases, or energy bills quickly escalate into serious problems. Employees often rely on credit, overdrafts, or high-interest borrowing, which only deepens financial pressure.

That pressure doesn't stay at home. It follows employees into the workplace, showing up as increased absence, distraction, and disengagement. For HR and payroll teams, this becomes a hidden cost that traditional payroll systems are not designed to address.

How Does Payroll Savings Work?

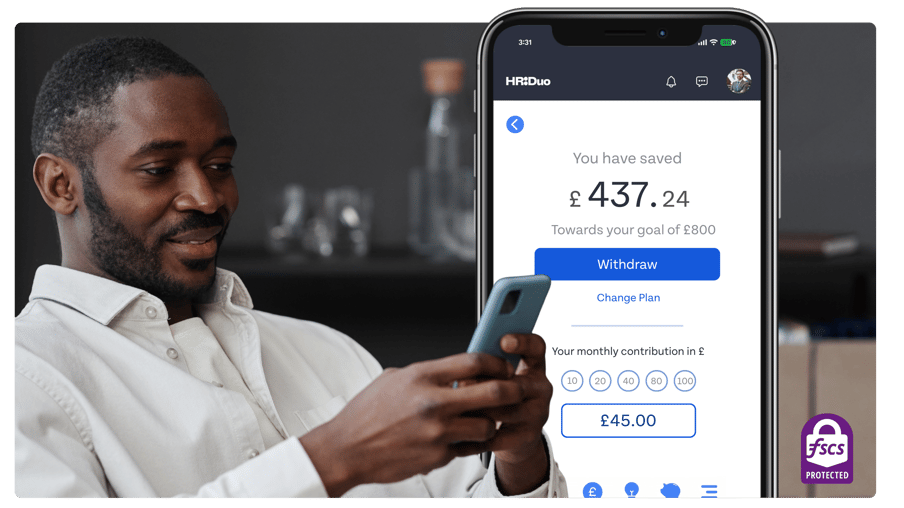

HR Duo already gives employees flexibility through Earned Wage Access, and Payroll Savings completes the picture.

-

On-Demand Pay helps manage short-term cash flow

-

Payroll Savings builds long-term financial resilience

Together, they support real financial wellbeing without increasing HR workload, with everything running through the same platform, connected to payroll. This fits naturally into modern HRMS environments where automation matters. Once enabled:

-

Savings are deducted automatically from payroll

-

No manual setup for each pay run

-

No change to existing payroll processes

-

No additional reporting burden

- FSCS protected

Employees can access earned pay when they need it, while also building a savings habit automatically through payroll. Savings are set aside before pay reaches their bank account, making it easier to save consistently without relying on willpower. There is no need for separate financial apps, manual processes, or added administration for HR teams.

For employers, this means one HR platform that brings together payroll, pay flexibility, and savings in a single, secure system. For employees, it means financial support that feels built-in, not bolted on, and comes at no additional cost.

Key Benefits for Your Workforce

Payroll Savings removes the reliance on willpower by changing how saving fits into everyday pay. Saving becomes a routine payroll action rather than a monthly decision, making it easier to build a habit and maintain it over time. For many employees, this is the first time saving feels achievable, consistent, and part of their normal pay cycle.

What employees get:

-

Save directly from payroll before payday

-

Automated contributions that run every pay cycle

-

Instant access savings account, no lock-ins

-

A high-interest instant access account

-

Average users save £100 more per month, often by setting aside the price of a daily coffee

The impact on financial wellbeing at work:

-

Employees save more, consistently, without extra effort

-

Reduced money-related stress and anxiety

-

Improved focus during working hours

-

Higher engagement and motivation across teams

Getting Started with On-Demand Pay and Payroll Savings

Fully protected by the Financial Services Compensation Scheme, Payroll Savings is now available to UK HR Duo users, alongside On-Demand Pay.

Request a demonstration of HR Duo and the financial wellbeing features.