Earned Wage Access (EWA)

Flexible on-demand pay to support your workforce

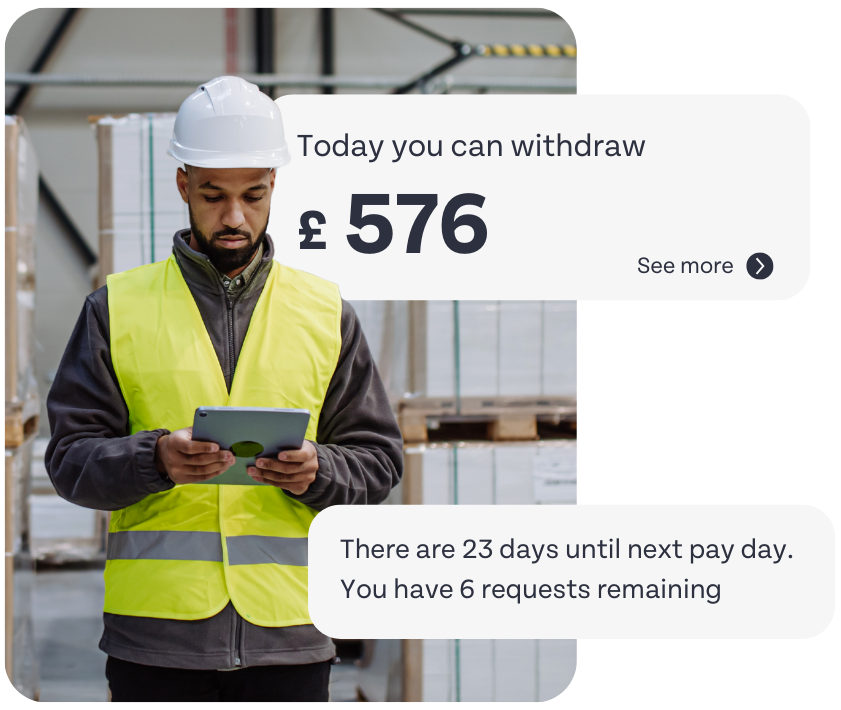

On-Demand Pay, also known as Earned Wage Access (EWA), enables employees to withdraw a portion of their earned wages before payday. It provides a debt-free solution for unexpected expenses, helping employees avoid high-cost alternatives such as payday loans or overdrafts.

A valuable financial wellness benefit that keeps your employees motivated

On-Demand Pay allows employees to access wages they’ve already earned, helping them manage cash flow, handle emergencies, and avoid high-cost credit options like payday loans. Businesses that offer this benefit report better staff retention, reduced absenteeism, and higher job satisfaction.

Employees can access earnings instantly

No interest or repayment obligations

Reduce financial stress and improve morale

Improve employee retention and recruitment efforts

Seamless integration with payroll

Simple, seamless, and built for modern workforce management

HR Duo makes it easy to introduce On-Demand Pay without disrupting your existing payroll processes. Employees can access their earnings in just a few taps, and the system automatically tracks and deducts withdrawals from their net salary on payday. No loans, no credit checks, and no added complexity—just a simple way to support your team’s financial stability.

Enable access in just a few clicks within HR Duo

Staff can withdraw a percentage of their wages

Employees receive their wages in seconds

The feature is accessible from mobile or desktop

Amounts are seamlessly deducted from payslips

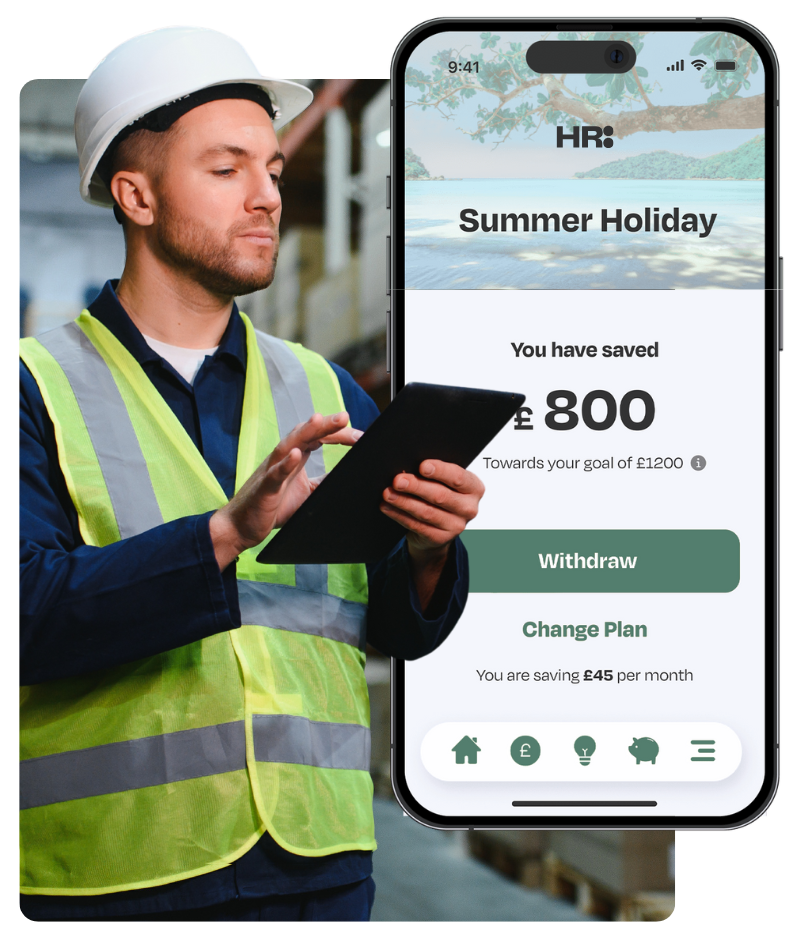

Automated savings tool that allows employees to save into a high-interest instant access account

With HR Duo's on-demand pay, employees also get access to an automated, high-interest savings tool that helps them prepare for a rainy day. Fully protected by the UK government under the Financial Services Compensation Scheme and free-to-use for staff. Makes building a savings habit easy and rewarding.

Workers can save directly from their pay before it arrives

The average user saves £100 more a month

Interest rates up to 3x higher than high-street banks

Boost financial well-being, reducing money worries

GDPR compliant for employee financial and personal data

Support employees' financial wellbeing

The business benefits of On-Demand Pay

Reduce Absenteeism

Employees with financial security are less likely to miss shifts or call in sick.

Increase Productivity

Financially stable employees are more engaged and focused on their work.

Employer of Choice

Join the growing number of businesses offering flexible pay to attract top talent.

Zero Cost & Admin Hassle

Fully automated with no impact on your company's cash flow or payroll workload.

Fill Shifts Faster

Employees are more likely to take on extra shifts when they know they can access their earnings immediately.

Reduce Turnover

Offering financial flexibility can improve retention, reducing hiring and training costs.

Why Does On-Demand Pay Matter?

The financial landscape is shifting, and employee expectations are evolving. On-Demand Pay is already offered by 15% of UK employers, and companies that implement it gain a competitive edge in recruitment, retention, and employee satisfaction.

62%

fewer unfilled shifts in companies with on-demand pay

13%

lower employee absence rates in staff with access to EWA

4mil

employees in the UK currently have access to on-demand pay

Everything you need to manage your workforce

We offer game-changing plans tailored to your specific requirements.

Workforce Management

A core solution to manage your frontline teams, enhance operations, and reduce labour costs.

What's included:

-

Time-Tracking

-

Digital Rotas

-

Shift Scheduling

-

Absence Management

-

Leave and Holiday

-

Payroll Reporting

-

Employee Profiles

-

Analytics and Reports

-

Project Tracking

-

Mobile App

-

Employee Self-Service

-

Geofence Clock-In

-

Subcontractor Management

-

Skills Matrix

-

Task Manager

-

Document Storage

-

Equipment Tracking

-

Permission Groups

-

Benefit Recording

-

Instant Messaging

-

Organisation Charts

-

Knowledge Centre

-

Platform Support

MoreLess

HR Assist

A one-of-a-kind offering that simplifies your people processes and automates up to 80% of your HR tasks.

What's included:

-

Connected Forms

-

Model HR Letters

-

HR Policy Templates

-

Integrated Emails

-

Digital Contracts

-

Secure E-Signature

-

Employee Relations Assistance

-

Employee Assistance Programme

EmployPath

Manage your entire employment lifecycle with the tools to help you recruit, engage, and nurture your people.

What's included:

-

Applicant Tracking System

-

Enhanced Onboarding

-

Performance Management

-

360 Reviews

-

One-to-ones

-

Improvement Plans

-

Goal & Objective Tracking

-

Analytics and Reports

Thinking of combining our plans?

Unlock top-notch workforce automation

Hey! Get a free demo of HR Duo today

Join thousands of managers across the UK and Ireland automating over 80% of their day-to-day operational tasks, with our unique combination of smart workforce management software and world-class HR technology.

Trusted by:

This is a free, no-obligation demo where our expert team will guide you around the HR Duo platform and help you decide if we're the right fit for you and your workforce.

Frequently Asked Questions

Here's a round-up of some of the questions we've been asked by business owners, operations managers and HR professionals looking to make the move to a unified Workforce Management platform like HR Duo.

What is On-Demand Pay?

On-Demand Pay, also known as Earned Wage Access (EWA), allows employees to access a portion of their earned wages before payday. Instead of waiting for the traditional pay cycle, employees can withdraw a percentage of their accrued but unpaid salary at any time.

How does On-Demand Pay work?

HR Duo automatically tracks hours worked and calculates the available earned income. Employees can request an advance on their accrued wages through the platform, and the funds are deposited into their bank account in seconds. The amount withdrawn is automatically deducted from their next payroll without requiring repayments.

Is On-Demand Pay a loan?

No, On-Demand Pay is not a loan. There are no interest rates, no credit checks, and no repayments. Employees are simply accessing their already-earned income before payday.

How does On-Demand Pay impact payroll?

On-Demand Pay integrates seamlessly with HR Duo’s payroll reporting. The feature is fully automated, meaning deductions are applied at the end of the pay cycle with no extra admin effort or impact on company cash flow.

Does On-Demand Pay cost anything for employees?

Yes, each transaction has a small transaction fee per withdrawal. This has been set at £1.95 per transaction. The fee is always transparent and disclosed before completing a withdrawal.